SMSF change of details email

The ATO has recently implemented a new practice of alerting authorised SMSF trustees via email and/or text message whenever changes are made within your self-managed super fund (SMSF).

If you have received this email for the first time you may be asking, what does this all mean? Has my retirement savings or data been exposed to fraud or misconduct?

The simple answer is likely not.

According to the ATO the email and text alerts are automatically sent whenever a request for a change of details has been lodged. This includes changes to:

- financial institution account details

- electronic service address (ESA)

- authorised contact

- members.

Who requested the change of detail?

More often our clients have received this alert directly after lodging their Annual Tax Return (AR) or Business Activity Statement (BAS).

Within the lodged return itself, their may be subtle details that your tax agent has included that might be slightly different than what is recorded with the ATO.

This may include:

- Details of a new SMSF bank account

- Details of the fund’s ESA (for a new fund or change of accountant)

- Details of a new member

On lodgement of the return, the ATO automatically update their details to match the return, and consequently the alert is triggered.

Alternatively, if outside the lodgement cycle of your annual tax, potentially your tax agent has simply requested a change of details directly. Still out of cycle changes should have been communicated with you so it is always best to check if in doubt.

I received the email, what should I do?

If you’re not aware of any changes being made to your SMSF, you should contact:

- the other trustees or directors of the corporate trustee of your SMSF

- other representatives authorised to make changes to your SMSF, such as your tax agent.

If you have recently changed SMSF accountants or administrators, there is a high probability that some details have changed, such as the authorised contact or ESA.

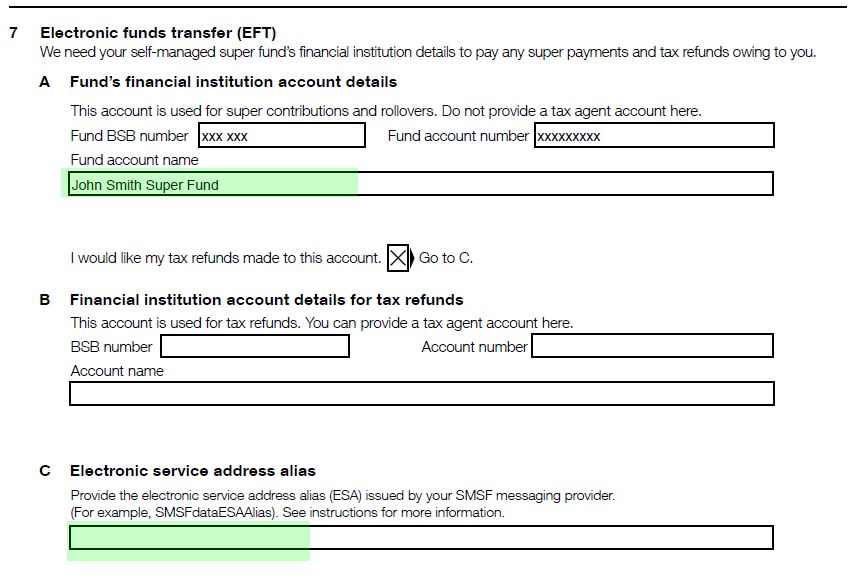

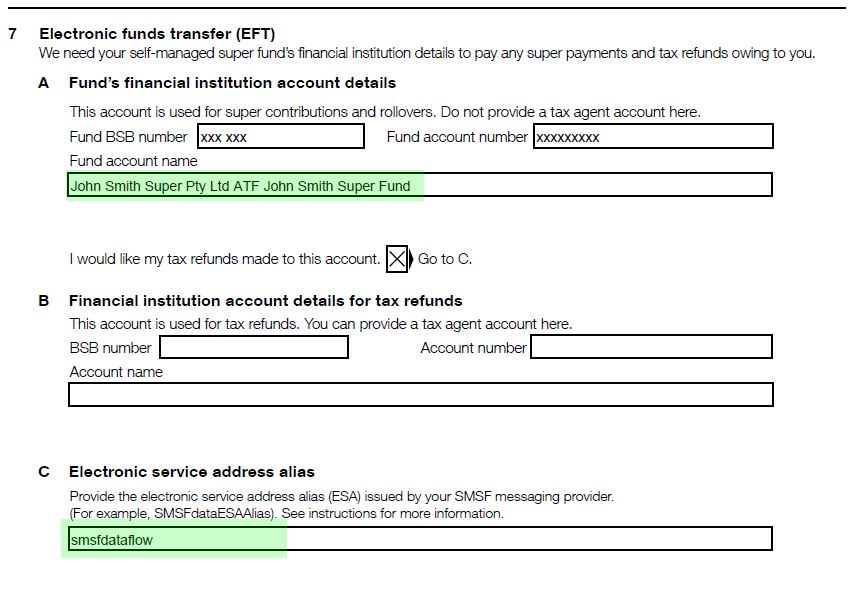

If you have recently lodged your SMSF annual tax return and would like to self assess what the potential changes might be, we recommend reviewing sections 7 of the current and prior years tax return first as shown below.

Example of 2019 Annual Return

Example of 2020 Annual Return

I have checked the above and I am still concerned

While there is often a likely reason behind the ATO email alert, if you are concerned the changes have been made incorrectly and without your knowledge, we recommend phoning the ATO on 13 10 20 between 8.00am and 6.00pm, Monday to Friday. Before you call, we recommend you have your TFN or ABN ready to establish your identity.

How can we help?

If you have any questions or would like SMSF Options to investigate any changes made to your SMSF account, please call us to arrange a time to meet so that we can discuss your particular circumstances in more detail.

About us…

SMSF Options is the home of Australia’s leading Self Managed Super Fund (SMSF) accountants, auditors, and advisers.

Covering all aspects of SMSF, our Gold Coast based team are passionate about what we do and take pride in our expertise. We know when it comes to Self-Managed Super, we can get the best possible outcomes for you and your fund.

Whether you are just starting off, transitioning to retirement or looking at the best way to pass wealth on to the next generation, we will help you maximize the benefits by assisting you with everything from setting up your own fund to looking after the daily administration, lodging your income tax return and arranging the fund audit.

Guy Wuoti – SMSF Options

Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.